Lending for a better future

We believe in better value for our customers, and a brighter future for our planet. We’re here to support your transition to a more energy-efficient home, wherever you are in your journey.

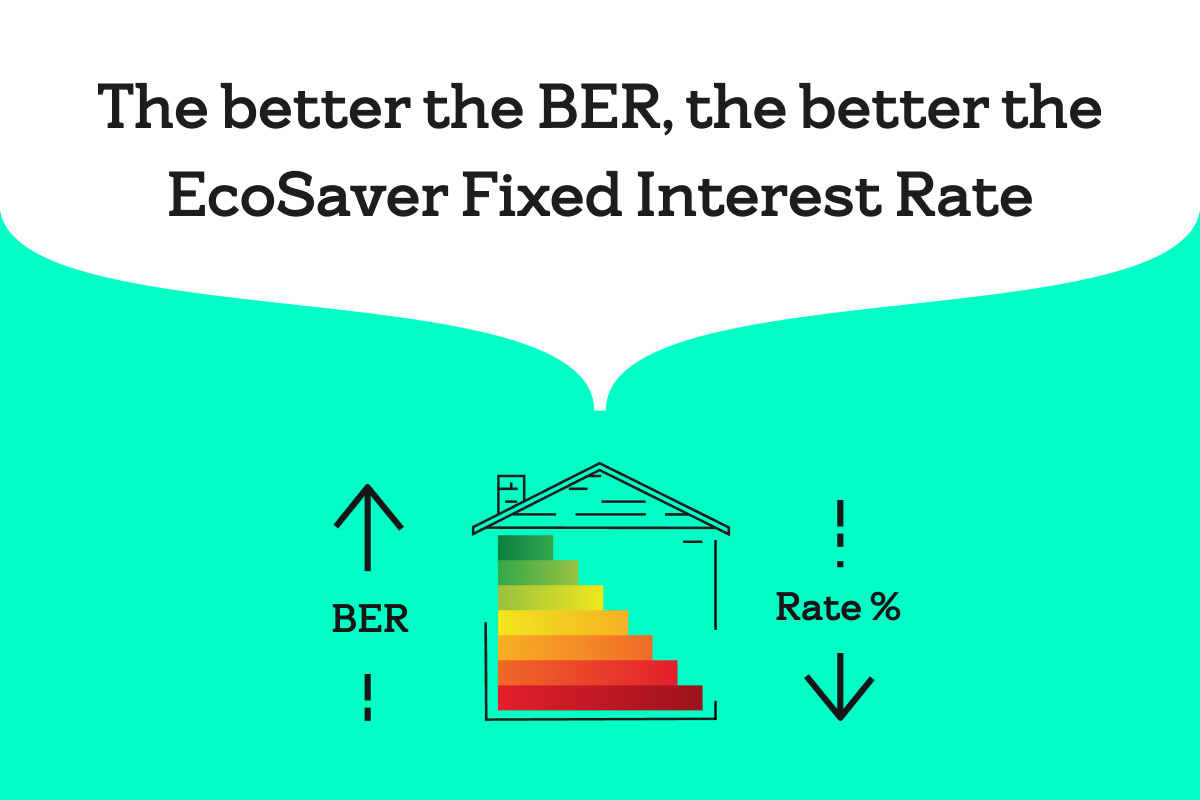

Provide your BER to get your EcoSaver Mortgage rate

Open to everyone – whether you’re a switcher, Bank of Ireland mortgage holder or first-time buyer.

See what upgrades you could do to your home

Plan works, estimate the costs and savings of improving your home’s energy efficiency and view financing options.*

One-Stop-Shop energy upgrades, in partnership with SSE Airtricity

We’ve partnered with SSE Airtricity, who will manage the entire home upgrade process for you as a One-Stop-Shop.

Getting Started

If you’re thinking about improving your home’s energy efficiency, buying a new property or you’ve already made home improvements, The EcoSaver Mortgage is for you.

You don’t need to be an existing Bank of Ireland customer or have a good Building Energy Rating (BER) to begin with – provide your BER to benefit from great EcoSaver Mortgage fixed interest rates, and every time you complete energy upgrades and your BER goes up a letter, we’ll bring your EcoSaver Mortgage interest rate down.

Find your Building Energy Rating

For your home, you’ll need the Metre Point Reference Number (MPRN) from your electricity bill. For a home for sale, you’ll need the BER number, which you’ll find in the property listing.

Search the BER RegisterSee what upgrades you could do to your home

Explore retrofit options, estimate the costs and savings of improving your home’s energy efficiency and view financing options. Every time you complete energy upgrades and your BER goes up a letter, we’ll bring your EcoSaver Mortgage rate down.*

*Subject to terms and conditions

Check our retrofit toolGet help paying for home energy upgrades

Pay with an EcoSaver Mortgage equity release or home energy improvement loan.

See financing optionsFind a registered contractor

To receive home energy grants, you must use an SEAI registered contractor who meets the technical, compliance and quality standards of the SEAI.

Find an SEAI-registered contractorOne-Stop-Shop energy upgrades, in partnership with SSE Airtricity

We’ve partnered with SSE Airtricity, whose award-winning One-Stop-Shop service, Generation Green Home Upgrade, will manage the entire process for you. From providing your BER and helping you choose the right home energy upgrade measures, to managing grants and project managing all works, SSE Airtricity will make your home cosier and more energy efficient with less hassle.

Learn moreGet your new BER certificate

Once you’ve made energy upgrades, you’ll need an inspection by an independent assessor registered with the SEAI. Then, send us the new certificate, and we’ll reduce your EcoSaver Mortgage fixed interest rate.*

*Subject to terms and conditions

Find a BER assessorSend us your new BER certificate

We’ll improve the fixed interest rate on your EcoSaver Mortgage. You can increase your BER to benefit from even better rates.*

*Subject to terms and conditions

Submit BER certificate

Good to know

Building Energy Rating (BER)

The energy efficiency of buildings is rated from most (A) to least efficient (G). Since 2007, a Building Energy Rating certificate is required for all homes for sale.

Get a BER assessment

For homes with an outdated BER or without a BER, you’ll need an independent assessor registered with the Sustainable Energy Authority of Ireland (SEAI).

Home energy upgrade grants

If you’re improving or adding insulation, heating controls, a heat pump or solar system to your home, you may qualify for SEAI grants.

*By using this service, you will be accessing a third party website. Bank of Ireland takes no responsibility for the accuracy of information from third party websites. Please be advised Bank of Ireland will not supply your data to a third party. For Bank of Ireland’s privacy notice, please click here.

The lender is Bank of Ireland Mortgages. Lending criteria and terms and conditions apply. A typical mortgage to buy your home of €100,000 over 20 years with 240 monthly instalments costs €613.16 per month at 4.15% variable (Annual Percentage Rate of Charge (APRC) 4.3%). APRC includes €150 valuation fee and mortgage charge of €175 paid to the Property Registration Authority. The total amount you pay is €147,482.50. We require property and life insurance. You mortgage your home to secure the loan. Maximum loan is generally 3.5 times gross annual income (4 times gross annual income for first time buyers) and 90% of the property value. A 1% interest rate rise would increase monthly repayments by €53.89 per month. The cost of your monthly repayments may increase – if you do not keep up your repayments you may lose your home. Available to over 18s only. APRC calculations are based on the cost per month on a €100,000 mortgage over 20 years.

The EcoSaver Mortgage fixed interest rate provides customers with discounts based on their Building Energy Rating (BER), the better the BER rating, the better the discount. The EcoSaver Mortgage is available to all customers, if you are new to Bank of Ireland or already have a mortgage with us. You can get The EcoSaver Mortgage fixed interest rate if you are borrowing to buy a home for yourself or your family or an investment property to let or you switching your mortgage loan to us from another lender. You must supply a BER (Building Energy Rating) certificate to avail of the EcoSaver mortgage. Available with fixed rates only.

The High Value Mortgage fixed interest rate is available to you if you are buying or building a property to live in as your home or are switching your mortgage loan to the Bank of Ireland Group from another mortgage lender outside our Group, AND you are borrowing €250,000 or more, AND you draw down your new mortgage loan before 31 December 2024. Cashback is not available with the High Value Mortgage Interest Rates.

Up to 3% Cashback is available to First Time Buyers, Movers and Switchers who draw down a new mortgage by 31 December 2024. 2% Cashback draw down of a new mortgage. 1% bonus in 5 years subject to meeting the conditions of the mortgage. Additional 1% bonus not available for Buy to Let Investment or Equity Release mortgages. Cashback is not available on High Value Mortgage fixed interest rates. As of 18 April 2024, cashback will not be available for new mortgage loans that draw down on a standard variable rate.

Bank of Ireland Mortgage Bank u.c. trading as Bank of Ireland Mortgages is regulated by the Central Bank of Ireland.

Frequently Asked Questions

Got a question? Our FAQs may help. Go to our Help Centre to see a full list of frequently asked questions.

Ready to move forward with your application?

Book an appointment Apply online Information & Legal notices

You can also request a callback or call us on 0818 365 345. Our phone lines are open Monday to Friday from 9am – 5pm.

Bank of Ireland Mortgage Bank u.c. trading as Bank of Ireland Mortgages is regulated by the Central Bank of Ireland