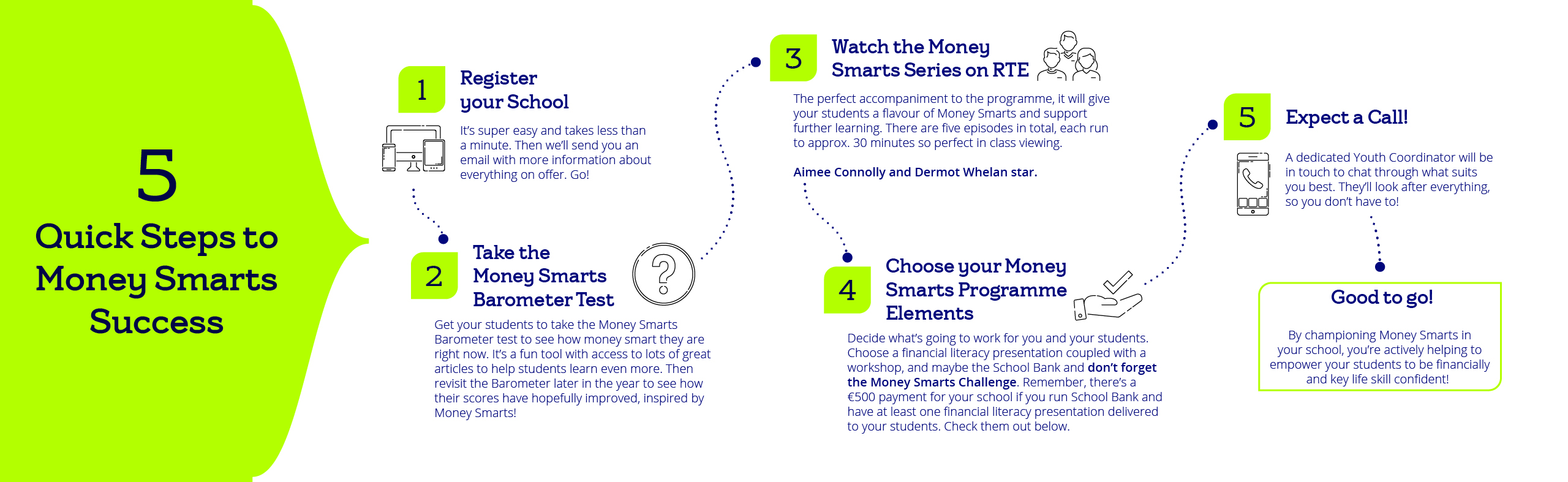

Money Smarts Programme for Secondary Schools

Register Your School93%1 of teachers agree students benefit

100%1 of teachers re-register

Award Winning2 Gold: Best Financial/Innovation

Over 300,0003 students participated

No. 1 for Financial Literacy 1

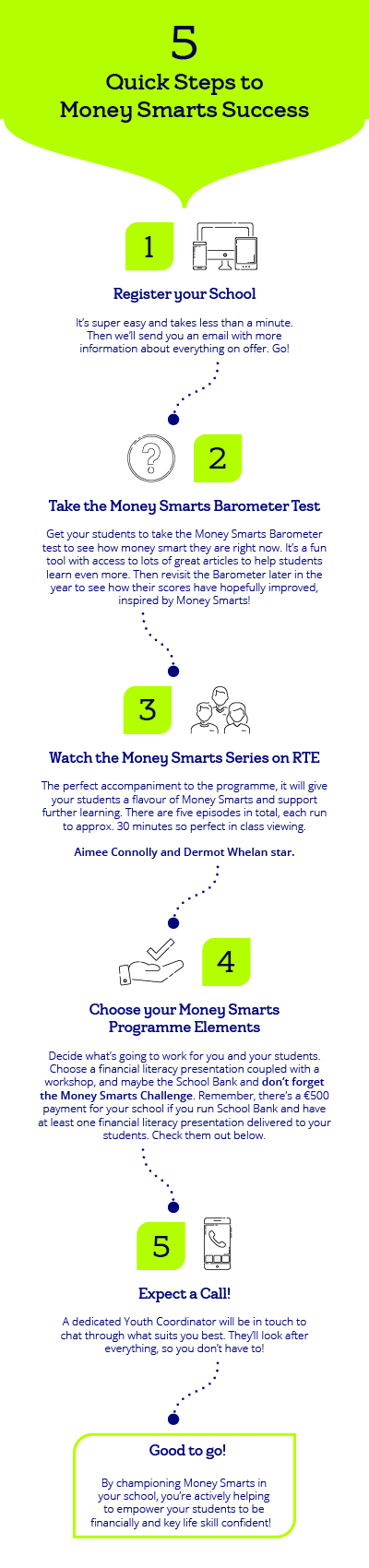

Want to empower your students to be financially confident? We can help you teach them the language of moolah! Considered to be the No.1 Financial Literacy Programme for Schools1, Money Smarts is packed with content, workshops and events designed to provide students with both financial literacy and key life skills they’ll benefit from for life.

Students can also put their financial literacy knowledge to the test to win some substantial prizes for their school and themselves, in the award winning Money Smarts Challenge.

Teachers! Our team of Youth Coordinators will deliver this programme content virtually to your students, at a time that suits you. So you’ve flexibility to plan around your class schedule.

Money Smarts and BSTAI

We’re proud to work closely with the Business Studies Teachers Association of Ireland who are avid supporters of the delivery of the Money Smarts Financial Literacy and Key Life Skills Programme in Irish secondary schools.

Financial Literacy Presentations

“Hits the right notes with students. Variety of programme content is great!”1

Suitable for Junior and Senior Cycle, and delivered virtually to students by a dedicated Youth Coordinator, each 40 minute Money Smarts Financial Literacy Presentation covers key Financial Wellbeing Topics e.g. Saving & Spending, Earning & Income, Credit & Debt, Investing & Risk, Financial Decision Making, Fraud and Banking Basics with fun quizzes and polls throughout to keep your students on their toes!

Everything learned in these presentations, could give your students the edge if you decide as a school to register for the Money Smarts Challenge.

Money Smarts Content Series with RTE

“It is an excellent programme. Great resources.”1

To support student learning further we’ve recently launched the Money Smarts Content Series with RTE. With 5 episodes in total, they complement the Money Smarts Financial Literacy Presentations and are the perfect interactive introduction to the overall programme. Well known experts share their stories on financial literacy and key life skills topics. Watch them with your students now if you like, to give them a flavour of Money Smarts!

Makeup mogul Aimee Connolly talks about her journey to becoming a successful business owner.

Watch Now

Over two episodes, Kel discusses how to gain control of spending and get smarter with money.

Watch Now

Cyber behavioural scientist Prof. Mary Aiken, shares fascinating insights and top tips for fraud protection.

Watch Now

Speaking from the heart, Dermot shares his story on how meditation helps him manage everyday stress.

Watch Now

School Bank

“Worthwhile programme, especially School Bank.”1

School Bank is set up by students, for students. Run on site in school, it has two great advantages.

It gives students the chance to interview for one of five roles on the School Bank Team. A stand out experience on any students’ CV, the team work together managing, operating and creating positive buzz around the School Bank offering and the 2nd Level bank account. Full training and support is provided by a dedicated Youth Coordinator.

It highlights for teenagers the opportunity they have right now, to take control of their finances. With their own bank account, students put their financial literacy learning in to practice every day, choosing how they will spend and save.

Practical Workshops

“Information students take away from the workshops is second to none.”1

Two popular workshops focus on practical key life skills. Each is delivered virtually and runs for 40 mins.

The CV & interview Skills Workshop contains everything a student needs to know about crafting a killer CV and bowling over a potential employer in an interview. Perfect for Junior Cycle, TY and LCVP students.

The Business Start-Up Workshop will help inspire and guide budding entrepreneurs as they learn about critical thinking, communication and problem solving skills.

Following the completion of each workshop, students can access a Post Workshop Pack with useful tips, extra articles and supports on topics covered. Perfect for TY Students about to embark on setting up their Mini Companies?

Money Smarts Challenge

A chance for your school to win big in the award winning Money Smarts Challenge 2025!

Find out more

Please note: Early registration for the Money Smarts Programme is highly recommended this year as places may need to be limited if there is increased demand for virtual delivery. So to avoid disappointment, secure your school’s place as soon as you can. Completion of the registration form for this programme does not guarantee a place.

Competitions are not an activity regulated by the Central Bank of Ireland.

Bank of Ireland is not responsible for information on third party sites