First Time Buyer Mortgage Calculator

When buying your first home, we know you’ll need some help along the way. That’s why we’ve designed our mortgage service around you.

Home buying calculators

To get started, our calculators can give you a rough idea of how much you might be able to borrow and what repayments to expect.

About these calculations:

For Movers in general, a mortgage of up to 3.5 times your gross annual income (combined income for joint applicants) and 90% of the property value is available to Home Movers but these limits can vary so talk to us if you need to discuss your options. The amount you can borrow will depend on your individual circumstances and is subject to lending criteria, terms, and conditions.

How The EcoSaver Mortgage works

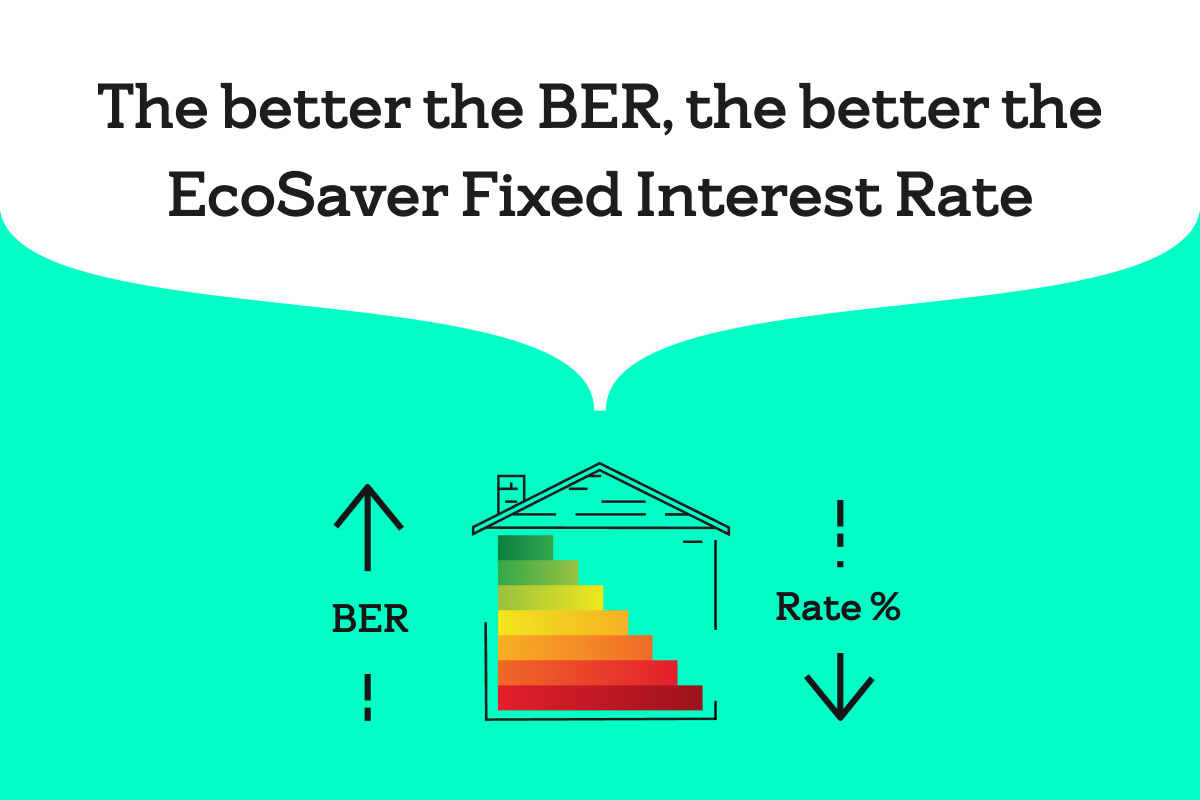

Provide your Building Energy Rate (BER) to get your EcoSaver Mortgage fixed interest rate.

Every time you complete energy upgrades and your BER goes up a letter, we’ll bring your EcoSaver Mortgage rate down* – just submit your BER certificate.

*Subject to terms and conditions

We’ve used our lowest 1 year fixed rate to estimate your repayments. Have a look at our other rate options available.

This calculator is for illustrative and guidance purposes only and is not an offer of a loan. The limits applied can vary so it’s important to talk to us as early as possible about your plans. The amount you can borrow will depend on your individual circumstances and is subject to lending criteria, terms and conditions.

If your receive a bonus, overtime or commission i.e. variable pay, a portion may be considered as part of your application – we’re happy to discuss this with you.

At the end of a fixed rate period, customers on a fixed rate can choose from our range of fixed rate options available to existing customers or roll to the Variable rate at that time.

If you entered into a fixed rate option prior to 18 April 2024, then you may be entitled to a Loan to Value (LTV) based standard variable rate upon maturity of that fixed rate period.

Terms of up to 35 years are available for First Time Buyers, Movers and Switchers. Fixed rates roll to the corresponding new business variable rate at the end of the fixed period.

The lender is Bank of Ireland Mortgages. Lending criteria and terms and conditions apply. Over 18s only. Mortgage approval is subject to assessment of suitability and affordability. You mortgage your property to secure the loan. We require property and life insurance.

Maximum loan is generally 3.5 times gross annual income (4 times gross annual income for first time buyers) and 90% of the property value, (70% of the full property value for Buy to Let) but these limits may vary.

The lender is Bank of Ireland Mortgages. Lending criteria and terms and conditions apply. A typical mortgage to buy your home of €100,000 over 20 years with 240 monthly instalments costs €613.16 per month at 4.15% variable (Annual Percentage Rate of Charge (APRC) 4.3%). APRC includes €150 valuation fee and mortgage charge of €175 paid to the Property Registration Authority. The total amount you pay is €147,482.50. We require property and life insurance. You mortgage your home to secure the loan. Maximum loan is generally 3.5 times gross annual income (4 times gross annual income for first time buyers) and 90% of the property value. A 1% interest rate rise would increase monthly repayments by €53.89 per month. The cost of your monthly repayments may increase – if you do not keep up your repayments you may lose your home. Available to over 18s only. APRC calculations are based on the cost per month on a €100,000 mortgage over 20 years.

EcoSaver Mortgage Fixed Interest Rate

The EcoSaver Mortgage fixed interest rate provides customers with discounts based on their Building Energy Rating (BER), the better the BER rating, the better the discount. The EcoSaver Mortgage is available to all customers, if you are new to Bank of Ireland or already have a mortgage with us. You can get The EcoSaver Mortgage fixed interest rate if you are borrowing to buy a home for yourself or your family or an investment property to let or you are switching your mortgage loan to us from another lender. You must supply a BER (Building Energy Rating) certificate to avail of the EcoSaver Mortgage. Available with fixed rates only. Terms and conditions apply.

You can also request a callback or give us a call on 0818 365 345.

Our phone lines are open at the following times:

- Monday – Friday: 9am – 5pm

Some reading you might find helpful

Can you afford to buy your first home?

Ready to move forward with your application?

Book an appointment Apply online Information & Legal notices

You can also request a callback or call us on 0818 365 345. Our phone lines are open Monday to Friday from 9am – 5pm.

Bank of Ireland Mortgage Bank u.c. trading as Bank of Ireland Mortgages is regulated by the Central Bank of Ireland