Our Climate Transition Plan

Our Climate Transition Plan (formerly our five point Climate Action Plan) outlines the key roles we are playing in facilitating Ireland’s green transition to a low-carbon economy and our own efforts in reducing our own emissions on the environment. As a signatory to the United Nations Principles for Responsible Banking (UNPRB), we are committed to aligning our strategy and practice with the Paris Climate Agreement.

- Decarbonisation Targets

- Sustainable Finance

- Decarbonising our operations

- Managing climate related risks

- Responsible Investing

- Nature

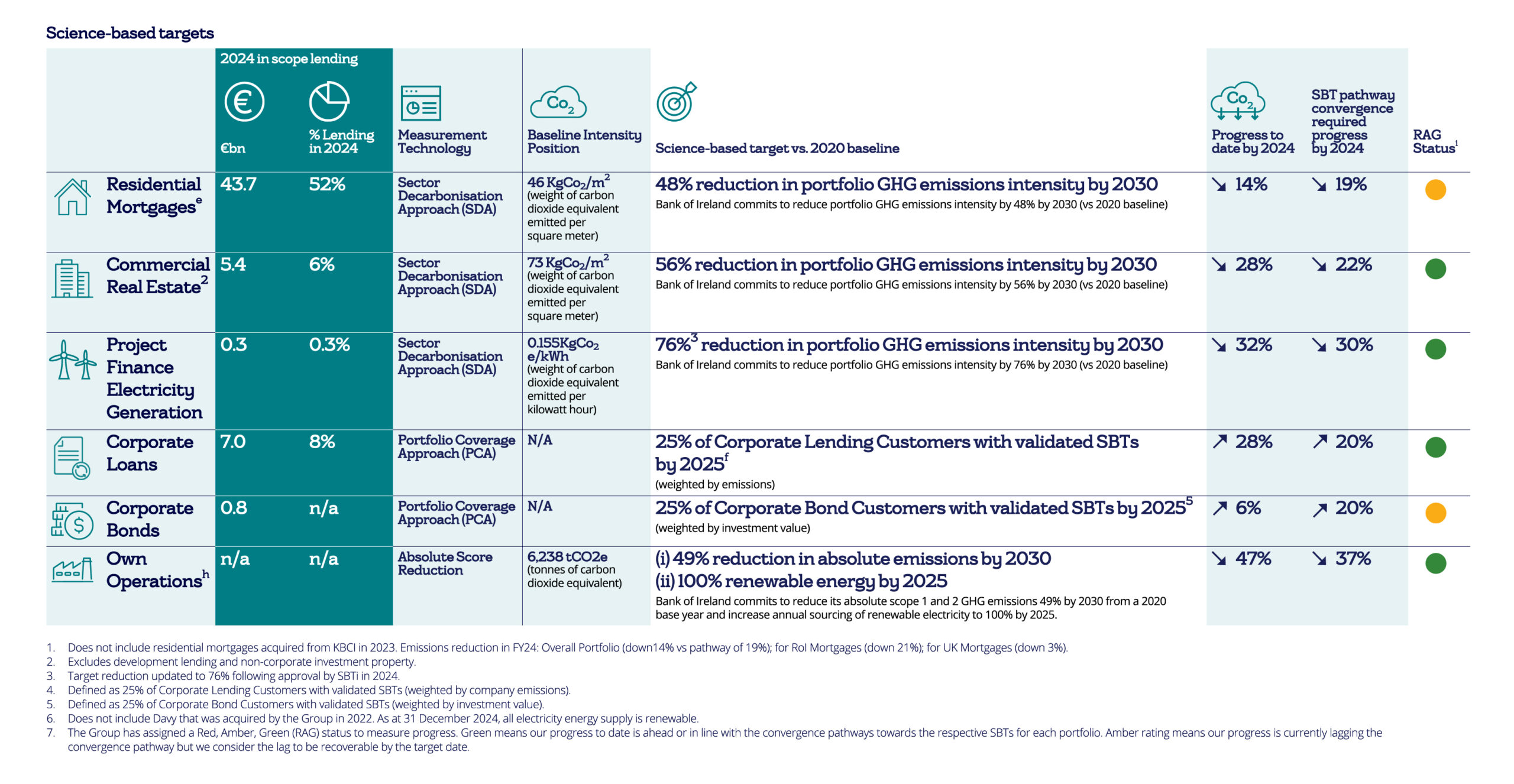

To ensure our lending portfolios and practices are on a pathway that is aligned with the Paris Agreement goals, we use decarbonisation targets validated by the globally recognised Science Based Targets initiative (SBTi) to track our progress covering all of our operations and 71% of our FY2020 baseline loan book.

The SBTi validated our target of a 49% reduction in greenhouse gas emissions (GHG) from our own operations (Scope 1 and 2), which supports our broader aim of net zero emissions in our own operations by 2030. Reduction targets have also been set for emissions arising from the Bank’s lending activities (Scope 3) which are consistent with levels required to meet the goals that are aligned to the 1.5°C Paris Agreement.

As part of our compliance with SBTi, we are required to regularly and transparently report on our progress against our targets.

We’re at the heart of the movement towards sustainability in Ireland, particularly in supporting the green transition in line with Ireland’s Climate Action Plan. Our goal is to help our customers adapt to this change.

A key part of our commitment is to develop financial products that support the transition. This aligns with our dedication to the UNPRB. Our range of sustainable finance products is carefully designed to help our customers make real, impactful changes. It includes a suite of sustainable finance products covering a range of sectors from Home Buying and Everyday Banking through to Corporate Banking. Each product is designed to fund and support our customers with innovations to help them transition towards a more sustainable business model and a low carbon future. In addition, we continue to develop partnerships in key sectors of the economy to bring innovative solutions to our customers, colleagues and society such as our Enviroflex agri-business loans which are now available to 95% of dairy farmers nationwide.

We’ve made significant strides towards meeting our sustainable financing targets of c. €15 billion by 2025 and c. €30 billion by 2030. We are on track to meet our €15 billion target in early 2025. By the end of 2024, our sustainable finance portfolio grew by c.32%, reaching €14.7 billion.

We are constantly developing and expanding our range of Sustainable Finance solutions. For the latest information on our product offerings and supports please see our dedicated personal Green Hub and Business Green Hub.

The SBTi validated our target of a 49% reduction in GHG emissions from our own operations (Scope 1 and 2) from a 2020 base year which supports our broader aim of net zero emissions in our own operations by 2030.

In 2024, we demonstrated our commitment to GHG reduction within our own operations with a 47% reduction in GHG emissions from our own operations versus a 2020 baseline.

These include completing a c.€5.5 million investment in energy-efficient LED lighting for Bank of Ireland branches across the island of Ireland and a further €3 million investment over 3 years in energy efficiency improvements across a number of our sites.

We will continue to work towards our commitment to making our own operations net zero by 2030 from a 2020 base year in addition to a secondary target to increase annual sourcing of renewable electricity to 100% by 2025.

Guided by the Group’s ESG Risk Management Framework we are progressively embedding environmental risk into the Group’s key risk processes. We work with our customers and suppliers to understand risks and impacts related to environmental matters and ensure these are mitigated. We do this, for example, by applying strict criteria in our lending decisions to exclude certain economic activities that are incompatible with our concern for the environment.

We also analyse the environment-related impacts across the industry sectors in our loan book. This information is guiding our strategy on how best to address both the risks and opportunities this collective challenge presents to both the Group and our customer base.

New Ireland Assurance is one of Ireland’s leading providers of pension, protection, and investment solutions. Their commitment to sustainability is not just a reflection of their values but a crucial component of their strategy and vision to be the partner of choice for wealth management and insurance services in Ireland, protecting families and businesses, investing their money and securing their future. As an asset owner, with over €25.5 billion in AUM, they integrate ESG principles into their operations throughout the business. This includes sustainable investing practices, responsible advice and support to customers.

As a responsible investor, they continuously work to improve and maintain the best product offerings for customers working with some of the world’s leading investment managers to achieve this. In 2024, over 43% of their policyholder AUM was invested in products that promote, among others, environmental and/or social characteristics. They have worked closely with their external investment managers over the last number of years to embed ESG principles deeply within many funds and mandates they manage on New Ireland’s behalf. This is achieved through; exclusions, ESG tilts, their voting activities and how they engage with the companies they invest in.

In 2024, they also successfully completed their second annual Principles for Responsible Investment (PRI) reporting cycle, demonstrating their commitment to responsible investment as signatories to the United Nations Principles for Responsible Investment (UNPRI).

We understand the global economic dependency on nature and ecosystem services and recognise we have a role to play in mitigating environmental impacts and supporting a transition to a net zero and regenerative economy. One of the main causes of environmental impacts is climate change, and through our Green Transition pillar, we also aim to address other drivers of environmental impacts, categorised as pollution, water stress, resource scarcity and biodiversity loss.

We understand that the biggest impact we can have is through the finance and guidance that we provide to our customers. Environmental objectives are integrated into our customer engagement strategies, sectoral strategies and lending procedures as part of our overall Sustainability Strategy, in line with UNPRB and European Central Bank (ECB) guidelines on environmental risk management.

We are also working to minimise the environmental impacts that arise from business activities, related to our own operations. While we recognise that the impacts of our financing activities far outweigh those of our own operations, these actions help us to understand the challenges faced by our business customers, so we can better support them as they progress on their own nature positive journeys. The mitigation of environmental impacts is integrated into our own operations and supply chain in line with the Group’s Environmental policy and Code of Supplier Responsibility.

We also joined a number of collaborative initiatives to support the ongoing development of nature related guidance, including the TNFD Forum, the Partnership of Biodiversity Accounting Financials (PBAF), and the UNPRB Nature Target Setting working group. We are also a member of the inaugural Irish Business and Biodiversity community of practice. In 2024, we continued to uphold our voluntary commitments around nature and built on our previous work with the United Nations Environment Programme Finance Initiative (UNEP FI) PRB by joining the Pollution Working Group during 2024 / 25.

We will continue to monitor the evolving regulatory and wider stakeholder approach to nature as we prepare for the upcoming refreshed Sustainability Strategy in 2026.

Relevant Sustainable Development Goals