Our Climate Action Plan

Our Climate Action Plan, first introduced in 2021, outlines the key role we play in facilitating Ireland’s green transition to a low-carbon economy and our efforts to reduce our own impact on the environment.

- Science Based Targets

- Sustainable Finance

- Decarbonising our operations

- Managing climate related risks

- Responsible Investing

- Nature

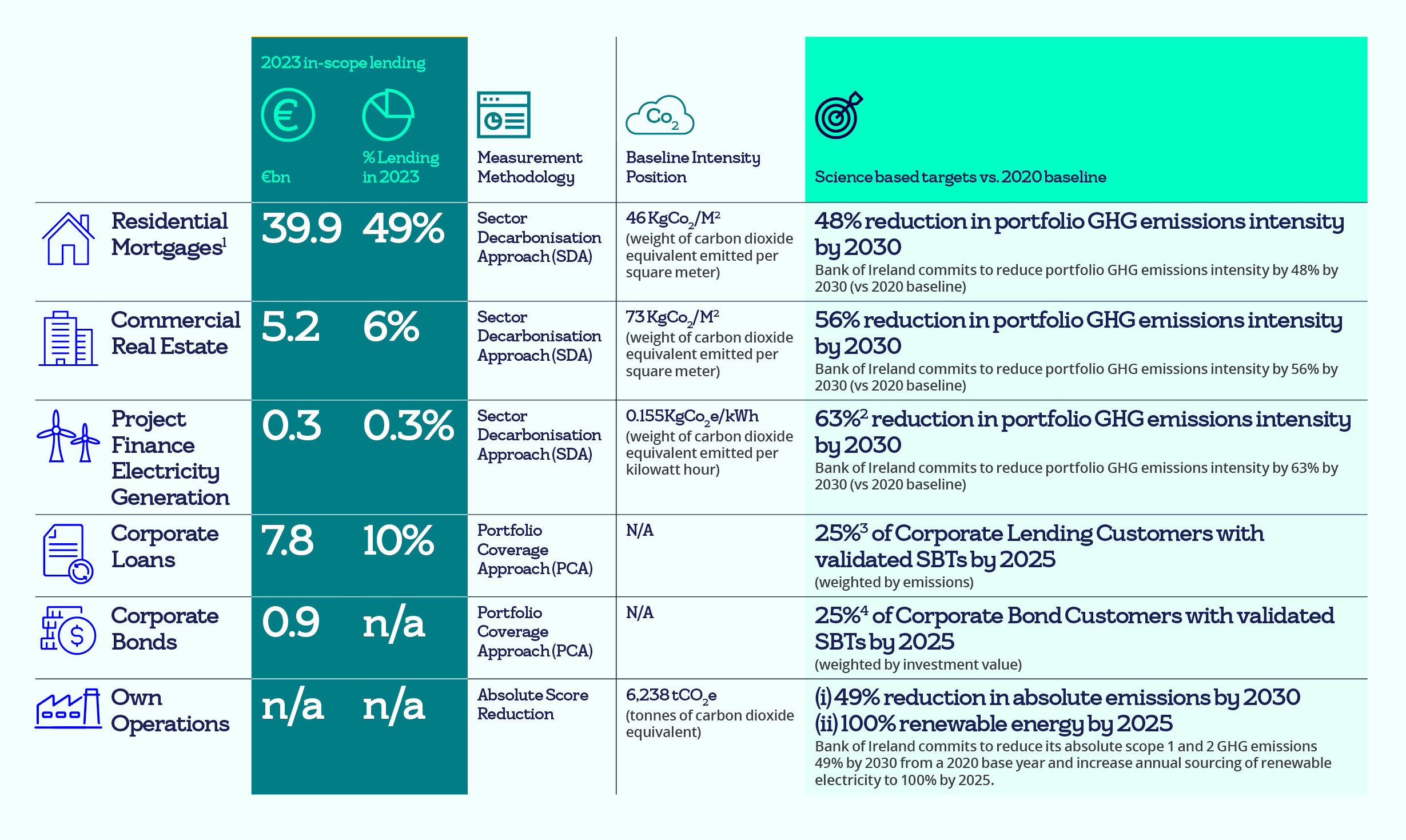

In 2022, we became the first Irish retail bank with greenhouse gas (GHG) reduction targets validated by the global gold standard Science-Based Targets Initiative (SBTi) initiative. These align our GHG reduction targets across our business operations and sustainable finance deployment to support the sustainable market transition for our customers. The targets cover all the group’s operations and 76% of our loan book and include Scope 1 and 2 emissions present in our operations and Scope 3 emissions in our downstream value chain.

The SBTi validated our target of a 49% reduction in GHG emissions from our own operations (Scope 1 and 2), which supports our broader aim of net zero emissions in our own operations by 2030. Reduction targets have also been set for emissions arising from the Bank’s lending activities (Scope 3) which are consistent with levels required to meet the goals that are aligned to the 1.5°C Paris Agreement.

As part of our compliance with SBTi, we are required to regularly and transparently report on our progress against our targets. We made our inaugural reporting disclosures on our progress against our SBTs for 2023.

We’re at the heart of the movement towards sustainability in Ireland, particularly in supporting the green transition in line with Ireland’s Climate Action Plan. Our goal is to help our customers adapt to this change.

A key part of our commitment is to develop financial products that support the transition. This aligns with our dedication to the United Nations Principles for Responsible Banking (UNPRB). Our range of sustainable finance products is carefully designed to help our customers make real, impactful changes. It includes a suite of sustainable finance products covering a range of sectors from Home Buying and Everyday Banking through to Corporate Banking. Each product is designed to fund and support our customers with innovations to help them transition towards a more sustainable business model and a low carbon future.

We’ve made significant strides towards our sustainable financing targets of c. €15 billion by 2025 and c. €30 billion by 2030. By the end of 2023, our sustainable finance portfolio grew by approximately 35%, reaching c. €11.1 billion.

We are constantly developing and expanding our range of Sustainable Finance solutions. For the latest information on our product offerings and supports please see our dedicated personal Green Hub and Business Green Hub.

We also provide sustainable finance advise to customers through Davy Horizons. Davy Horizons work as trusted adviser, supporting organisations implement bespoke sustainability solutions to drive long term success. Their offering is designed to help organisations adapt and navigate the increasingly complex ESG landscape for a diverse range of stakeholders. They cover strategic advice, through to practical implementation and reporting across all ESG thematic funds. The Davy Horizons Team has over 60 years’ combined experience in advising public, private and not-for-profit organisations on how to meet their sustainability goals across all ESG issues.

The SBTi validated our target of a 49% reduction in GHG emissions from our own operations (Scope 1 and 2) from a 2020 base year which supports our broader aim of net zero emissions in our own operations by 2030.

In 2023, we demonstrated our commitment to GHG reduction within our own operations by achieving over 85% of our SBTi 2030 target in GHG emissions from our own operations (Scope 1 and 2).

We continue to work towards our commitment to making our own operations net zero by 2030 from a 2020 base year in addition to a secondary target to increase annual sourcing of renewable electricity to 100% by 2025.

We recognise that the climate-related risks we face need to be identified, assessed and managed on an ongoing basis to minimise negative impacts. We’re committed to supporting our customers’ green transition while building the Group’s resilience against these negative impacts by embedding climate-related impacts in key decision making processes.

Guided by the Group’s ESG Risk Management Framework, we are progressively embedding climate risk into the Group’s key risk processes. We continue to improve how we assess climate risk drivers taking into account potential impacts, our mitigating actions, and next steps for each risk type.

In 2023 the focus of Group ESG risk management expanded to include non-climate environmental risks. We have a detailed multi-year (2021-2024) Climate Risk Implementation Plan in place to address the ECB guidance on how banks should manage climate related and environmental risks. Execution of the plan has seen us progressively align to the ECB guidelines on climate risk management in respect of strategy, risk governance and measurement.

Progress continues to be made on embedding climate risk and ESG considerations in business and credit processes in line with the Board approved plan.

New Ireland Assurance is part of Bank of Ireland Group and one of the country’s leaders in providing pension, protection and investment solutions. As an asset owner with in excess of €22bn assets under management (AUM), they strive to be a sustainable insurer and a responsible investor and partner with best in class managers, a number of whom are market leaders in ESG investing. They incorporate ESG factors into their investment management processes, customer advice and the development of innovative solutions for customers. Since 2017 they’ve paid out €738m in life and serious illness cover, €143m on income protection and paid 20,000 annuitants over €500m in income further underpinning their commitment to financial wellbeing for customers.

They offer customers a range of funds that promote Environmental and Social characteristics. These SFDR Article 8 Funds account for approximately 38% or €7.5bn of their policyholder AUM. These funds have a sustainability focus. They seek to consider sustainability risks when designing and reviewing funds and continue to work with their investment managers to formalise stewardship and engagement priorities in relation to disclosures, proxy voting and engagement.

They are signatory to the UN Principles for Responsible Investment (PRI), as are 90% + of their delegated investment managers and have made significant progress on the implementation of their Sustainability and ESG strategy through regulatory compliance and the integration of ESG into their investment decision-making processes.

We understand the intrinsic links between climate and nature, and that our economic and societal wellbeing are highly dependent on ecosystem services. So we’ve begun to assess our nature-related impacts, dependencies risks and opportunities using reputable market tools and frameworks, and by piloting the Taskforce for Nature-Related Financial Disclosures’ LEAP framework.

We have also joined a number of collaborative initiatives to support the ongoing development of nature related guidance, including the TNFD Forum, the Partnership of Biodiversity Accounting Financials (PBAF), and the United Nations Principles for Responsible Banking (UNPRB) Nature Target Setting working group. We are also a member of the inaugural Irish Business and Biodiversity community of practice.

In recognition of the potential for the transition to a circular economy to reduce up to 90% of impacts on biodiversity, we have also joined Circuléire, Ireland’s national platform for innovation in manufacturing, to support work in this area. Our next steps will be reducing our impacts on nature through revised policies, processes and targets over the coming years.

Relevant Sustainable Development Goals