Let’s start with a single euro...

It’s simple, compounding is one of the easiest ways to grow your investment and all compounding needs to work its best is time. Let’s start with a single euro.

I found a euro coin in my pocket recently. I only remember because it was sparklingly clean having been through the wash. Earlier in the week I’d come across an article that explored Warren Buffet’s (a superstar of the investment world) claims that a return of 6-7% per year should be expected over the very long term. This got me wondering what I could actually do with just this one coin.

Of course 7% is the average return expected by Warren. Some years that number will be higher and some years it will be lower but over the long term it could average at about 7% every year.

The MSCI world index is a common benchmark for global stocks and shares. Over the past 40 years this index has actually averaged over 12% per year. Remember, during that time we had more than one market crisis such as in 2008 where the index dropped as much as 40% in one year. There were good times too with increases of over 40% in other years. The key is that if an investor stayed invested long enough the ‘ups’ should outweigh the ‘downs’.

So, back to our one euro. 7% growth on our euro is only 7c in year one which might initially sound small but this is where time and compounding come in.

In year two the growth will be based on 1 euro and 7 cent so it will grow by about a half cent more. It’s that half cent that makes such a huge difference when time is involved.

Every year the amount of potential investment growth will be exponentially bigger, this simply means that it will grow at a faster rate the longer its left invested.

So the only thing I’m adding to my one euro investment is time, but I am going to throw as much as I possibly can at it.

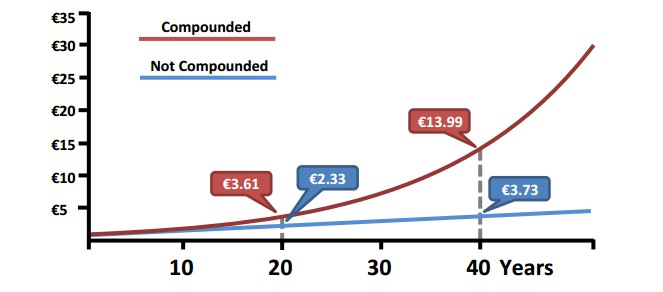

In the above example I’m assuming steady growth of 7% per year. In reality the lines will be a bit more wobbly but should still be moving in the same general direction. As you can see,

after 10 years my euro has grown to about €1.85 and after another 10 it’s worth €3.61. As you can imagine the theme continues and by year 40 it’s up to almost 14 euro.

So...

Remember this is all from just one euro, nothing else added other than time. Now maybe 91c is a bit underwhelming but let’s say we invested 10,000 euro, at the end of the 40 years it could be growing by 9,100 euro every year. Now that is something.

Of course there is tax on investment growth, every investment journey is different and every person has their own attitude towards taking risk. A 40 year investment is also quite long but

compounding is relevant even over 10 or 20 years.

The good news is that Investing is inherently compounded. It’s not something you need to request. Ultimately time is more valuable to an investment than you might think.