Whatever your age or circumstances, or whatever enormous changes may be going on in the word right now, it’s always a good idea to plan for your retirement.

1.Save tax

Save tax:

- On pension contributions

- On investment growth

2.Your income could drop 70%

Your income could drop by almost 70% in retirement as the maximum State Pension (Contributory) is €14,419* a year, but the average wage is €50,394** a year.

* Annual State Pension Contributory 2024

**Source: CSO, Average earnings in Q1 2024, Earning and Labour Costs June 2024.

3.You may need an income for up to 30 years

You may need an income for up to 30 years or more when you retire. This could amount to as much as a third of your life, so it makes sense to save now.

4.State Pension Age

The State Pension (Contributory) is payable at age 66 however you can delay the payment of the State Pension in return for an increased rate. Starting a pension now can bridge this gap.

5.Start Early

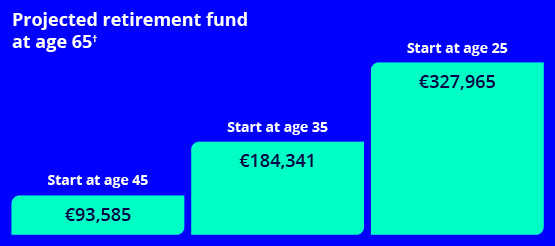

Starting pension contributions early can have a significant impact on your retirement fund. If you start paying €250 a month from age 25 your projected pension pot would be almost €328,000. If you wait until you’re 45 to start, that could be just €94,000.†

† The figures are based on level monthly contributions of €250. This illustration assumes a gross investment return of 5.75% per annum. This rate is for illustration purposes only and is not guaranteed. Actual investment growth will depend on the performance of the underlying investments and may be more or less than illustrated.

Warning: These figures are for illustration purposes only. They are not a reliable guide to the future value of your investment

6.Up to 40% tax relief

Higher rate taxpayers can benefit from up to 40%* in tax relief on every €1 saved. A €100 contribution only costs you €60. And even if you pay tax at the standard rate, you can benefit from 20% tax relief.

*Assumes higher rate tax payer. It is important to note that tax relief is not automatically guaranteed; you must apply to and satisfy Revenue requirements. Revenue limits, terms and conditions apply.

7.Growth

A pension can give you a great opportunity for growth, as well as access to a wide range of investment funds which can give your money the best potential for growth over the longer term.

8.Lump sum

At retirement, you may be able to take a retirement lump sum, tax free, subject to a limit of €200,000.*

* Revenue rules apply.

9.Investment Choice

Choose from a wide range of investment funds from global investment managers.

10.Start now

The sooner you start the better. Even if you’re older, it’s not too late. You can claim tax relief on a higher percentage of your earnings, so there is still time to catch up.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in this product you may lose some or all of the money you invest.

Warning: If you invest in this product you will not have access to your money until your retirement date

Warning: Past performance is not a reliable guide to future performance

Disclaimer

Life assurance and pension products are provided by New Ireland Assurance Company plc., trading as Bank of Ireland Life. New Ireland Assurance Company plc., trading as Bank of Ireland Life is regulated by the Central Bank of Ireland.

Advice on life assurance and pension products are provided by Bank of Ireland.

Bank of Ireland is a tied agent of New Ireland Assurance Company plc trading as Bank of Ireland Life for life assurance and pensions business.

Bank of Ireland trading as Bank of Ireland Insurance & Investments, Insurance & Investments and Bank of Ireland Premier is regulated by the Central Bank of Ireland.

Members of Bank of Ireland Group. Information correct as of August 2024.