-

Understanding credit card interest

Using a credit card can be helpful, but it's important to understand how interest works so you do not end up paying more than you expected.

Put simply, credit card interest is the cost of borrowing money. If you do not pay your full balance by the due date, interest is added to what you owe.

Here's how it works.

-

Types of credit card interest

Not all interest is the same. Here are the main types:

- Purchase interest

This is charged when you buy something and do not pay off the full amount. It's the most common type.

- Balance transfer interest

If you move a balance from one card to another, this is the rate that applies. It's often different from the purchase rate.

- Cash advance interest

Taking out cash with your credit card? Interest starts right away. And it's usually higher than other types.

- Promotional interest

Some cards offer low or 0% interest for a limited time. These deals can be great, but make sure you know when the promo ends. The regular rate will kick in after that.

-

Explaining the jargon

Here's what the main terms mean:

- Annualised interest rate = monthly interest rate on your credit card statement x 12

- Daily rate = annualised interest rate ÷ 365

- Daily interest = balance on your card × daily rate

- Monthly interest = daily interest × number of days in the month.

-

How is interest calculated?

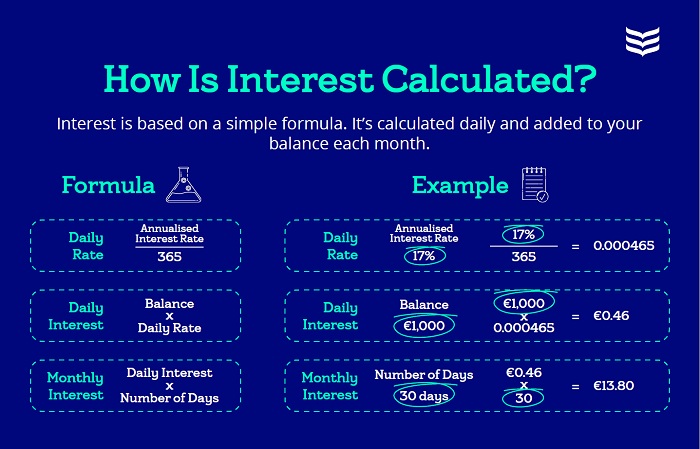

Interest is based on a simple formula. It's calculated daily and added to your balance each month.

Here's how it works:

The best way to understand it is with an example:

If your annualised interest rate is 17%, your daily rate is about 0.000465.

If you have a €1,000 balance on your card, that’s around €0.46 in interest a day

Over 30 days, that adds up to about €13.80 in interest.

-

How to avoid paying interest

Good news. You can avoid interest altogether with a few smart habits:

- Pay your full balance by the due date each month

- Avoid cash advances, unless it's an emergency

- Pay more than the minimum to reduce your balance faster

- Keep track of promotional rates, so you're not caught off guard when they end.

-

Need help with credit card debt?

If you’re feeling overwhelmed, you’re not alone. You do not have to face it by yourself. Many banks, including Bank of Ireland, offer support to help you manage your repayments. The sooner you reach out, the more options you’ll have.

Disclaimer:

The information prepared above by Bank of Ireland “BOI” is for information purposes only and does not constitute financial or tax advice. You should seek assistance from a professional if you require financial or tax advice. No liability is accepted by BOI for any errors or for any loss to any person in reliance on this information. BOI believes any information to be correct at 19/08/2025, the time of publishing and the information is subject to change without notice. BOI does not make any representations or warranties in respect of the accuracy of this information and is not responsible for the content of external sites. Please refer to our Terms & Conditions for the use of the Bank of Ireland Group Website for further details.

Interest calculations may vary across different products and product providers. Please check the terms and conditions of your credit card for more information on how your credit card interest is calculated.

Please note: the annualised interest rate may not be the same as the standard interest rate or the annual percentage rate.