It's so important to review your pension

Is that enough?

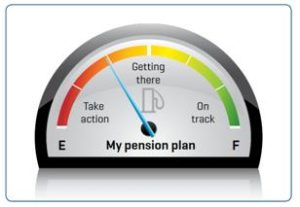

It’s great that you have a pension plan in place, but do you know what income it will provide you with in retirement? Taking out a pension plan is the first step on your journey to financial

independence in retirement. However it doesn’t necessarily mean that your financial future is taken care of.

It is important to have a clear understanding of what income your current level of pension savings is likely to provide you with.

You should then compare this against the income you think you will need to support the lifestyle you want after you stop working.

Reviewing your pension plan with an Advisor in your Bank of Ireland branch every year or two will allow you to assess your progress and give you the opportunity to adjust the amount you’re saving, your expectations, or both so that there are no surprises as retirement approaches.

How do I know if I’m on track?

You can get a projection of your expected income in retirement from your pension provider.

You can then compare this against the income you think you will need in your retirement and take action if there’s a shortfall.

Depending on the type of pension plan that you have, you may be able to pay more into your plan by increasing your contributions into that plan, or by taking out a separate Additional Voluntary

Contributions (AVC) plan. If you are a member of a pension scheme through work, you should check if your employer will match your increased payments.

How much should I be saving?

As a general rule of thumb you should be aiming for an income of between 50% and 66% of your final salary. However, everyone’s situation is different and it really depends on the type of lifestyle that you want in retirement, as well as on your own specific circumstances.

One approach is to use your current income and outgoings as a starting point. Using a monthly bank statement plus any known annual outgoings you can add and remove costs that will be associated with your retirement years. For example, when you retire you may no longer have monthly mortgage repayments or have to pay for children’s education, but you may take more holidays or have higher medical expenses. This will give you a rough idea of the income you might need in retirement.

An Advisor in your Bank of Ireland branch can look at your current pension plan and work with you to explore the amount you should be saving each month to meet your income needs in retirement.

I stopped saving into my pension plan, should I start saving again?

Many people who stopped paying into their pension plan during the recession have restarted their pension contributions. The reality is that the longer you leave it, the greater the impact will be as you will need to increase your pension contributions or lower your income expectations.

An Advisor in your Bank of Ireland branch can meet with you and help you get back on track towards saving for a comfortable lifestyle in retirement.

In general you should be able to bring all of your pension savings together into one plan.

However, there are conditions around moving your pension and it can depend on the type of pension arrangement you have versus what you want to transfer it into. Generally, on leaving employment you have three main options depending on the circumstances:

1. Leave your benefits in your existing pension arrangement.

2. Transfer your benefits to your new pension arrangement.

3. Take a refund of contributions, in limited circumstances.

You should make sure that you are fully aware of the implications of moving your pension savings before making any decision.

Note: There is a limit on the maximum fund that can be built up on retirement. This is currently €2,000,000. This figure includes all of your pension funds, including the

capital value of any retirement benefits drawn down since 7th December 2005. Where the relevant limit is exceeded, the excess in your pension funds at retirement will

be liable to a once off Income Tax charge.

Some people assume that having a pension is enough, but that’s not necessarily the case. You need to be confident that what you are currently saving into your pension will meet your income needs in retirement.

That’s why it is so important to review your pension at least once a year to ensure it is on track, so that you have the time to adjust it if it’s not.

Realising you could have a shortfall in your retirement income early on means that you have an opportunity to bridge the gap, both in terms of time and affordability.