When you’re under 30, starting to save for life after retirement may be far from your mind. After all, you may have big financial commitments on the horizon - like buying a house or starting a family. You may also be concerned by the current level of financial uncertainty.

So thinking about your lifestyle after you stop working might seem like a very distant priority, and one that you might not feel you’re able to afford right now. But there are good reasons to think differently.

Your working life isn’t your whole life

The working years between your twenties and sixties are the time when you are likely to earn the most money. Obviously, this income gets eaten up as you support yourself and your family during the four decades or so of your working life. After all, life isn’t cheap. But there is life after work and it is getting longer.

After you retire, you may need an income for over 30 years

People are living longer. That’s obviously a good thing, but, when you stop working, you might have another 30 years of retirement ahead of you. So another way of thinking about your income is that it is earned over 40 years but has to support your lifestyle for 70 years.

Now, imagine you have a savings plan that helps make sure that the money you earn during your working life lasts your whole life. In essence, that’s what a pension is.

A pension plan can provide you with an ongoing income to ensure you have the money you need to enjoy your retirement years. But only if you start one.

Your income could drop by over 70% if you rely solely on the State pension

When you retire, you may want to have a similar lifestyle to the one you enjoy today. However, unless you put a plan in place now to fund for your retirement, your income in retirement could drop by over 70%.

For most adults in full-time employment, the maximum State Pension (Contributory) is currently €12,912* a year (or €248.30 a week), but the average salary in Ireland is much larger at €45,111**. That’s a potential drop in income of €32,199 a year from the day you retire.

How will you bridge that drop in income? You need to start saving for your retirement as early as possible to help reduce the gap and the impact it will have on your lifestyle.

If you qualify for the State pension, you could be 66 before you get it

The age you are eligible for the State Pension (contributory) is 66. This was meant to be extended in 2020 to 67 from 2021 and 68 from 2028. However, in Budget 2021, it was announced that the qualifying age for the State Pension would remain at 66.

If you choose to retire before aged 66, you could have a gap in your retirement income.

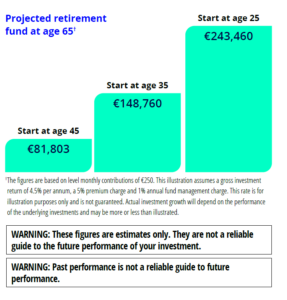

The sooner you start, the more you can save

The sooner you start saving for your retirement the more you will have when you retire.

The figures are based on level monthly contributions of €250. This illustration assumes a gross investment return of 4.5% per annum, a 5% premium charge and 1% annual fund management charge. This rate is for illustration purposes only and is not guaranteed. Actual investment growth will depend on the performance of the underlying investments and may be more or less than illustrated.

Think of a pension as tax-efficient saving, not as a bill to be paid

Pensions are simply a tax-efficient way of saving for your retirement. Importantly, you can get tax relief on your contributions, which means that putting €100 into a pension only costs you €60 *assumes a higher rate taxpayer. It is important to note that tax relief is not automatically guaranteed; you must apply to and satisfy Revenue requirements. Revenue limits, terms and conditions apply.

Remember: pensions are flexible. You can usually stop contributions if your circumstances change and start again at any time. This has happened unexpectedly for many people in the current pandemic.

Getting help

One of our financial planning managers can talk to you to discuss what income you might need when you retire and help you put a plan in place based on:

- your current age

- your expected retirement date

- the lifestyle you want when you retire

- what you can realistically afford to save.

* Annual State Pension Contributory www.welfare.ie

**Source: CSO, Average earnings in Q1 2021, Earning and Labour Costs June 2021.

Disclaimer

Life assurance and pensions products are provided by New Ireland Assurance Company plc., trading as Bank of Ireland Life. New Ireland Assurance Company plc., trading as Bank of Ireland Life is regulated by the Central Bank of Ireland.

Advice on Bank of Ireland Life products is provided by Bank of Ireland, trading as Bank of Ireland Insurance & Investments. Bank of Ireland trading as Bank of Ireland Insurance & Investments is regulated by the Central Bank of Ireland.

Bank of Ireland is a tied agent of New Ireland Assurance Company plc trading as Bank of Ireland Life for life assurance and pensions business.

Members of Bank of Ireland Group.