-

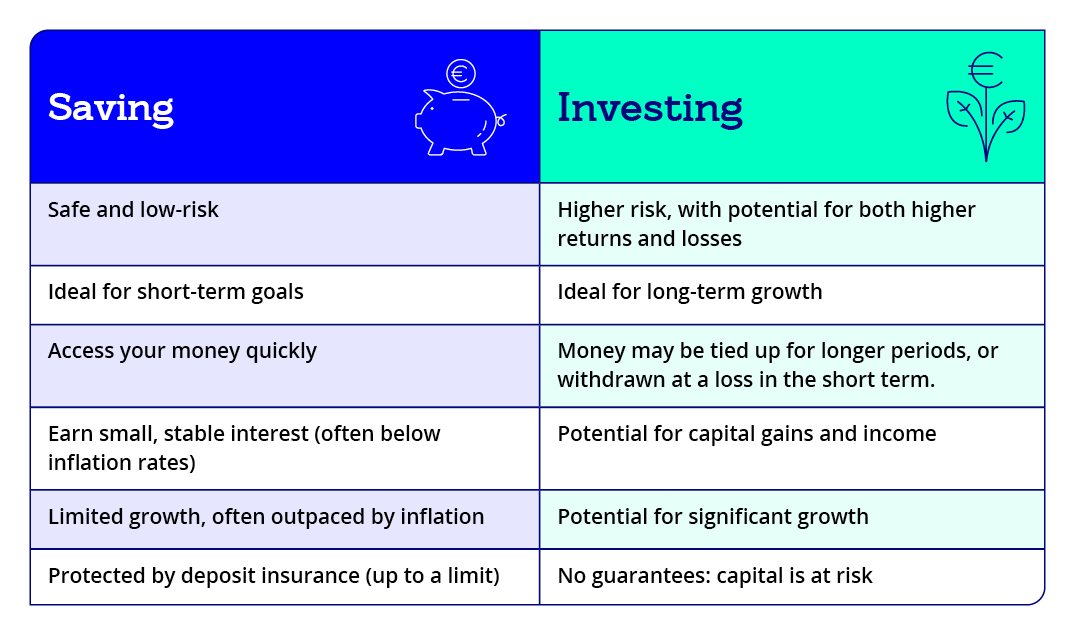

Back to basics: what does saving mean?

Saving means setting aside money for the future in a secure way, typically in a bank account, where it may earn some interest. While it won’t grow quickly, the primary goal is accessibility and security—for emergencies, planned expenses, like buying a car or a deposit for a house, or just peace of mind.

-

So, what’s investing about?

Investing aims to earn higher returns than savings.

While investing offers the potential for returns, its important to remember that they are not guaranteed and there is a risk you could lose some or all of the money you put in.

-

What are investments?

Investments are tools like stocks, bonds, or funds that help your money grow. Spreading your money across a mix of assets can reduce risk and give your wealth room to flourish.

-

What does risk mean?

Saving usually means steady and low risk - your money’s safe but won’t grow much. Your money is covered, subject to limits, by the deposit guarantee scheme. Investing can help your money grow faster, but there’s a chance you could lose some or all of it too. Risk sits on a scale, from low (like savings) to high (like shares or funds), where the rewards and the risks are both greater. Your Bank of Ireland financial advisor will seek to tailor an investment plan to suit your attitude to risk.

-

How soon will you need access to your money?

If you’ll need your cash within the next five years, saving is your go-to. But if you can commit to investing for more than 5 years, there are a range of options for you to choose from which could potentially provide better returns than deposits in the longer term. This could be important if you want to achieve longer term goals such as building a child’s education fund or saving towards your retirement. Finding which approach is right for you is important.

-

Before you begin to invest

Before you start investing, make sure you have an emergency fund in place. Start by saving at least 3 to 6 months of living expenses in an account you can access easily. It might take time to build this, but this buffer ensures that you’re financially protected in case of unexpected situations like your washing machine breaking down or car needing new tyres. If savings 3-6 months’ worth of living expenses feels out of reach, start small - setting aside a little each week or month can add up over time and help you build a solid safety net. The important thing is to just get started.

-

What about debt?

If you have high-interest debt—like credit cards or overdrafts, pay off the this debt in full as soon as possible, You'll reduce the total amount you owe more quickly – and free up money to put toward savings or investing later.

-

What are your long-term goals?

Planning to retire comfortably, travel the world, or help your children through college? Whatever your big dreams, the earlier you start planning, the better.

Savings accounts are great place to keep your money safe and accessible, but they tend to offer lower returns, especially over the long-term.

Investments, on the other hand, have the potential to grow significantly over time especially if you don’t need to access your money for five years or more. Investing gives your money a chance to work harder and bring those bigger goals within reach.

Takeaway : Saving and investing each have their moment in the spotlight. Saving keeps your money safe and ready for short-term needs, while investing is your go-to for building long-term wealth. The key is figuring out what works for you: your goals, your timeline, and how much risk you’re comfortable with. Start today, and let your money do the hard work for you!

Our financial wellbeing hub can help you get the answers

Learn more

Set a goal today with our Supersaver account

Learn more

Begin your investment journey today

Learn more

Life assurance and pensions products are provided by New Ireland Assurance Company plc., trading as Bank of Ireland Life. New Ireland Assurance Company plc., trading as Bank of Ireland Life is regulated by the Central Bank of Ireland.

Advice on Bank of Ireland Life products is provided by Bank of Ireland, trading as Bank of Ireland Insurance & Investments. Bank of Ireland trading as Bank of Ireland Insurance & Investments is regulated by the Central Bank of Ireland.

Bank of Ireland is a tied agent of New Ireland Assurance Company plc trading as Bank of Ireland Life for life assurance and pensions business.

Members of Bank of Ireland Group.

The information prepared above by Bank of Ireland “BOI” is for information purposes only and does not constitute financial or tax advice. You should seek assistance from a professional if you require financial or tax advice. No liability is accepted by BOI for any errors or for any loss to any person in reliance on this information. BOI believes any information to be correct at 12/09/2025the time of publishing and the information is subject to change without notice. BOI does not make any representations or warranties in respect of the accuracy of this information and is not responsible for the content of external sites. Please refer to our Terms & Conditions for the use of the Bank of Ireland Group Website for further details.

Bank of Ireland is regulated by the Central Bank of Ireland.