Funding your future

Create a pension plan for the retirement lifestyle you want

Begin your pension journeyAre pensions a mystery to you? You’re not alone – only 40% of people truly understand how they work. Retirement planning is on the minds of 38% of the population, but just 39% are aware of the tax breaks associated with pensions and only 22% seek professional advice about starting one. Join us as we explore the compelling reasons to start a pension plan.

Why should I save into a pension?

1. You may need an income for up to 30 years after you retire

People we are living longer these days, which means you could be retired for a long time. You may need an income for 30 years or more after you retire. That’s why it’s a great idea to begin saving for your retirement by putting money into a pension now.

2. Your income could drop by over 70% when you retire

The maximum amount of State Pension (Contributory) payments you can receive in a year totals just under €13,800*. However, the average wage is €48,021** a year. That means, if you rely solely on a State Pension, your annual income could drop by over 70% when you retire. Saving into your own pension will help reduce that drop.

*Annual State Pension Contributory www.welfare.ie

**Source: CSO, Average earnings in Q1 2023, Earning and Labour Costs May

2023

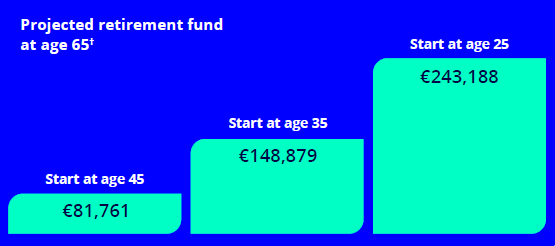

3. The earlier you start, the better

Starting a pension early can have a BIG impact on your retirement fund. If you start paying €250 a month from age 25, your projected pension pot would be over €243,188 when you hit 65. If you wait until you’re 45 to start, it could be just *€81,761.

*Figures are based on level monthly contributions of €250. This illustration assumes a gross investment return of 4.5% per annum, a 5% premium charge and 1% annual fund management charge. This rate is for illustration purposes only and is not guaranteed. Actual investment growth will depend on the performance of the underlying investments and may be more or less than illustrated.

If you save into a pension as a higher rate taxpayer, you can get up to 40%* in tax relief on every €1 you pay into your pension. This means paying €100 into your pension monhly only ‘costs’ you €60 a month. And even if you pay tax at the standard rate, you can get still 20% tax relief.

*Assumes higher rate tax payer. Source: Revenue.ie. It is important to note that tax relief is not automatically guaranteed; you must apply to and satisfy Revenue requirements. Revenue limits, terms and conditions apply.

How much could I earn when I retire?

Just tell us your date of birth, the amount you save each month and the value of any current pensions you have and we’ll calculate what your monthly income will be in retirement.

Try our pension calculator

Where can I learn more about pensions?

Our Pension Pot webinar series is hosted by industry experts who simplify pensions and help you understand your options. Learn about the great tax advantages, discover the importance of knowing where your pension money goes, and get tips on planning for a fantastic retirement and improving your long-term financial wellbeing.

Baz and Nancy’s pension prep

For this webinar series, Baz Ashmawy and his Mammy, Nancy, have enlisted the help of Bernard Walsh, Head of Pensions and Investments at Bank of Ireland, to demystify pensions and planning for the future. Together they’ll show you why you shouldn’t be scared of pensions and why you should absolutely have one.

Watch nowRevenue limits, terms and conditions apply. Tax relief is not automatically granted, you must apply to and satisfy Revenue requirements.

Life assurance and pensions products are provided by New Ireland Assurance Company plc., trading as Bank of Ireland Life. The Company may hold units in any funds mentioned on its own account. New Ireland Assurance Company plc., trading as Bank of Ireland Life is regulated by the Central Bank of Ireland. Member of Bank of Ireland Group.

Advice on Bank of Ireland Life products is provided by Bank of Ireland, trading as Bank of Ireland Insurance & Investments. Bank of Ireland trading as Bank of Ireland Insurance & Investments is regulated by the Central Bank of Ireland.

Bank of Ireland is a tied agent of New Ireland Assurance Company plc trading as Bank of Ireland Life for life assurance and pensions business. Member of Bank of Ireland Group.