Many people do not realise the financial impact that an unexpected illness, injury or premature death can have on a family. The unfortunate reality is that Irish families are struck by these events every day, and the financial impact can be both significant and long-lasting. A once in a century event such as a global pandemic reminds us of the need to plan for the unexpected.

If you earn an income, own a home, have dependants, a business or an investment property, then protecting yourself and your family against the financial impact of ill-health, injury or death is one of the most important decisions you can make.

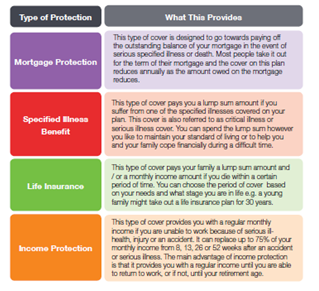

Having the facts to hand means you can make an informed decision about what protection you and your family may need. Let us explain the different types of protection available from Bank of Ireland Life and how we can help you and your family financially should things go wrong.

Helping you protect what’s important to you

We insure our home, our car, our holidays and sometimes even our family pets but the very thing we often overlook is the most important of all: ourselves, and our families. Having a protection plan in place is an effective way of providing peace of mind, reassuring you that you have financial protection for the things that are most important to you.

Ask yourself

If you suffered from a serious illness, injury or accident

- Would the cost of your medical care affect your financial well-being and that of your family?

- How long could you and your family cope financially?

- Would your income stop if you were unable to work for a prolonged period of time?

If you died prematurely

- How would your death impact your family’s standard of living and future plans?

- Would there be sufficient money in place to clear loans and bills, leaving your family debt-free?

- Would your family have the money needed to pay for your funeral?

- Finally and most importantly, where would your family get an income from to maintain their current lifestyle?

Types of protection plans available

Life Choice is a protection plan that offers a number of different benefits each tailored to meet your own circumstances. If you have a family, own your own home or own your own business or investment property, Life Choice can provide options to suit you

How much protection do you need to put in place?

Everyone is different and the level of cover you need will depend on your individual circumstances. As these change, so too will the amount of cover you need. You can put a protection plan in place with tailored cover that suits your needs and budget. This will help to ensure you and your family are financially secure in the event of serious ill-health, injury or premature death.

What will influence the cost and the amount of cover you need?

The cover you and your family might need will depend on your circumstances:

- Your age.

- Whether or not you have dependants - and if so, how many.

- Your salary.

- How long you would like to be covered for.

- Your level of borrowings.

- The amount and type of existing savings and investments you have.

- Whether or not you have any existing cover in place, including benefits provided by your employer

- The regular income your family would need to maintain their current lifestyle.

You can get a good idea of how much cover you need by considering the following 4 items

1.Regular Income: You should consider how much of your current monthly income is used to keep your household running and maintain your current lifestyle. You should also consider any additional costs that might be incurred if you became ill or passed away. Childcare costs is a good example in this regard.

2.Lump Sum Amounts: If you have a mortgage, as well as repaying your mortgage balance, you need to think about what once-off payments would have to be made on your death. For example, this could include payments to cover existing loans such as a car loan, debts, funeral expenses, or funds you would like to be made available to your dependants. It is a good idea to have one year’s net income as a rainy day fund, and providing for this will increase the amount of cover you need.

3.Existing Cover: You need to take account of any existing cover you may have, whether it’s another insurance policy or a benefit paid by your employer. This will have the effect of reducing the amount of cover you need.

4.The Term (Decide How Long You Want Your Cover to Last): In general, people tend to take life cover out over a 10 to 20-year term. As a good rule of thumb, however, if you have dependants you should look to take out cover until your youngest child is 25.

Terms and conditions apply. Benefits are subject to underwriting and acceptance by Bank of Ireland Life. It is important to understand that certain restrictions and exclusions may apply.

Disclaimer

Life assurance and pensions products are provided by New Ireland Assurance Company plc., trading as Bank of Ireland Life. New Ireland Assurance Company plc., trading as Bank of Ireland Life is regulated by the Central Bank of Ireland.

Advice on Bank of Ireland Life products is provided by Bank of Ireland, trading as Bank of Ireland Insurance & Investments. Bank of Ireland trading as Bank of Ireland Insurance & Investments is regulated by the Central Bank of Ireland.

Bank of Ireland is a tied agent of New Ireland Assurance Company plc trading as Bank of Ireland Life for life assurance and pensions business.

Members of Bank of Ireland Group.